Keywords: Rigetti Computing, Innovate UK grant, Quantum ML techniques, Financial data streams

Introduction

In recent years, quantum computing has emerged as a promising technology with the potential to revolutionize various industries, including finance. Rigetti Computing, a leading company in the field, has been awarded an Innovate UK grant to develop innovative quantum machine learning (ML) techniques for analyzing complex financial data streams. This collaboration between Rigetti Computing, Amazon Web Services (AWS), Imperial College London, and Standard Chartered aims to leverage the power of quantum computing to enhance classical machine learning methods used by financial institutions. By combining the capabilities of quantum and classical computing, the consortium aims to address the limitations of traditional techniques and unlock new possibilities in the financial sector.

The Need for Quantum-Enhanced Machine Learning in Finance

Financial institutions deal with vast amounts of complex data streams that require continuous analysis and interpretation. Traditional machine learning techniques have been used to assist in credit risk evaluation, market-making services, and predicting emissions in the context of green finance. However, these techniques have limitations when it comes to processing highly complex data streams efficiently.

This is where quantum computing comes into play. Quantum computers have the potential to process certain types of information more efficiently than classical computers alone. By combining quantum computing with classical machine learning methodologies, it is possible to develop more powerful resources for processing financial data streams. This collaboration aims to explore the potential of quantum-enhanced machine learning in the finance sector.

Objectives of the Collaboration

The consortium led by Rigetti Computing, in collaboration with AWS, Imperial College London, and Standard Chartered, has defined several research objectives to develop and benchmark quantum machine learning techniques for financial data streams. These objectives include:

- Further development of quantum signature kernels and quantum-enhanced feature maps.

- Benchmarking the results against classical machine learning methods for streamed data.

- Building and studying quantum algorithms for computing signatures and signature kernels for long and high-dimensional data streams efficiently.

The signature, a key concept in rough path theory, provides a top-down description of a data stream while filtering out local superfluous and noisy information. The consortium aims to leverage quantum computing to enhance the classical signature kernel methods, which have shown promise in scaling signature methods to high-dimensional streams.

The Role of Rigetti Computing

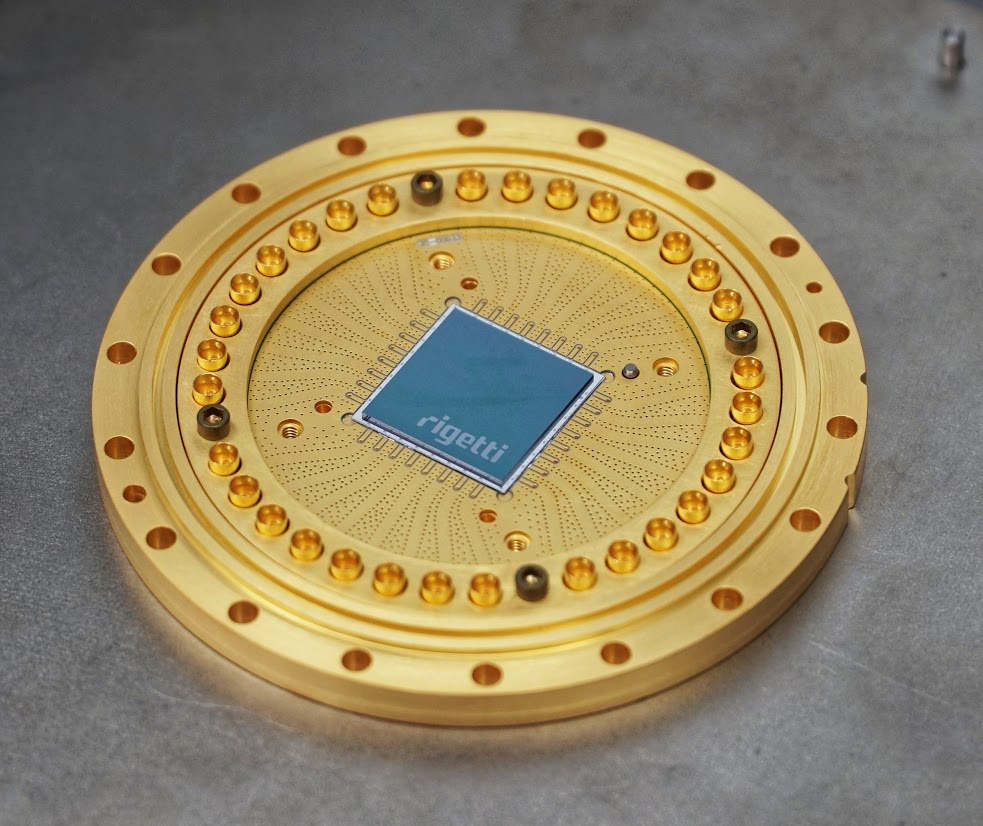

Rigetti Computing, a pioneer in full-stack quantum computing, will play a crucial role in this collaboration. The company operates quantum computers over the cloud and provides quantum computing services through its Rigetti Quantum Cloud Services platform. Rigetti Computing has developed a multi-chip quantum processor, enabling the scalability of quantum computing systems.

By leveraging Rigetti’s quantum computer and software, the consortium aims to develop and test quantum machine learning algorithms for financial data streams. Rigetti Computing’s expertise in quantum computing technology will be instrumental in advancing the development of quantum applications for the finance sector.

The Role of AWS

Amazon Web Services (AWS), a leading cloud computing provider, brings its high-performance computing resources to the collaboration. AWS’s classical computing infrastructure will be utilized to assist in benchmarking the quantum machine learning techniques developed by the consortium. This collaboration highlights the importance of combining quantum technologies with classical compute infrastructure to accelerate innovation in quantum machine learning algorithms.

Richard Moulds, the general manager of Amazon Braket at AWS, emphasizes the significance of leveraging classical HPC resources to advance quantum machine learning. The collaboration between Rigetti Computing, Imperial College London, and Standard Chartered not only benefits the finance sector but also encourages other industries to explore new machine learning models and improve quantum algorithm performance.

The Role of Imperial College London

Imperial College London, one of the leading universities in the UK, brings its expertise in classical machine learning models for data streams to the collaboration. The Department of Mathematics at Imperial College London is known for its research and teaching excellence in mathematical sciences. The department’s research strategy aligns with Imperial’s academic strategy, emphasizing collaboration and translating ideas into real-world impact.

Dr. Cristopher Salvi, a lecturer in Mathematics and Machine Learning at Imperial College London, highlights the potential of combining quantum technologies with rough paths techniques to develop more scalable signal processing algorithms for complex financial data streams. The collaboration with Rigetti Computing, AWS, and other partners will contribute to the UK’s efforts in quantum computing research.

The Role of Standard Chartered

Standard Chartered, a leading international banking group, brings its datasets and expertise in the finance sector to the collaboration. As financial institutions increasingly embrace quantum computing, Standard Chartered recognizes the importance of adopting new technologies early to future-proof its operations. By collaborating with Rigetti Computing, Imperial College London, and AWS, Standard Chartered aims to strengthen its position as an industry leader in a future quantum-ready economy.

Craig Corte, the Global Head of Digital Channels and Client Data Analytics at Standard Chartered, emphasizes the significance of quantum computing in driving business transformation. The collaboration provides access to high-performance computational resources and quantum algorithm expertise, enabling Standard Chartered to explore new opportunities and enhance its efficiency and productivity.

The Research Timeline

The project, which started on January 1, 2024, is expected to last for 18 months. During this period, the consortium will work collaboratively to develop and test quantum machine learning techniques for financial data streams. The research will involve further development of quantum signature kernels, benchmarking against classical machine learning methods, and building quantum algorithms for efficient computation of signatures and signature kernels.

The consortium aims to demonstrate the commercial application of quantum computing for finance and unlock the potential of quantum-enhanced machine learning. The outcomes of this research could have a significant impact on the finance sector and pave the way for broader adoption of quantum technologies in other industries.

Conclusion

The collaboration between Rigetti Computing, AWS, Imperial College London, and Standard Chartered represents a significant step towards harnessing the power of quantum computing for financial data analysis. By combining quantum and classical machine learning techniques, the consortium aims to overcome the limitations of traditional methods and unlock new possibilities in the finance sector.

Rigetti Computing’s expertise in quantum computing, AWS’s high-performance computing resources, Imperial College London’s research excellence in machine learning, and Standard Chartered’s industry experience together create a strong foundation for this collaboration. The research objectives defined by the consortium are aimed at developing and benchmarking quantum machine learning techniques for financial data streams, ultimately enabling financial institutions to improve efficiency and make better-informed decisions.

As quantum computing continues to advance, collaborations like this one will play a crucial role in shaping the future of the finance industry and other sectors that rely on complex data analysis. The results of this research could pave the way for the broader adoption of quantum technologies and the realization of their full potential in real-world applications.